32+ refinance mortgage requirements

Web To do a conventional cash-out refinance youll need to have owned the home at least six months unless you inherited the property or were awarded it in separation divorce or domestic partner. Web Current minimum mortgage requirements for FHA loans Down payment.

Reasons Not To Refinance A Mortgage The New York Times

Web To qualify for a mortgage refinance you must meet basic requirements.

. Web 2 days agoThe PSLF Program is a program that forgives the remaining balance on Direct Loans after borrowers have made 120 qualifying monthly payments under a qualifying repayment plan while working full. FHA borrowers must pay two types of FHA mortgage insurance. Typically a credit score of 580 is required to qualify.

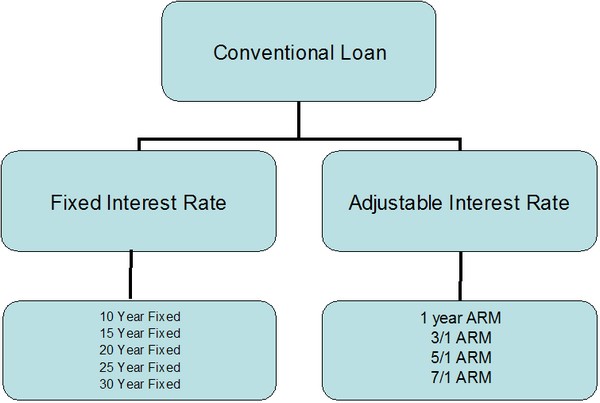

FHA rate and term refinance. Web Typically mortgage refinancing options are reserved for qualified borrowers. Web Conventional lenders require mortgage insurance to cover the risk of making loans with less than a 20 down payment.

Web Conventional cash-out refinance requirements Minimum 620 credit score Maximum 80 LTV ratio Maximum 45-50 DTI ratio Home appraisal required to verify value No mortgage insurance One bonus perk. For purposes of determining coverage under 102632 an open-end consumer credit transaction is the account opening of an open-end credit plan. You have three business days to decide whether to sign the loan agreement after you receive the special Section 32 disclosures.

Qualifying for an FHA Simple Refinance means meeting certain requirements including credit score and income limits. The lesser of 8 or 1103 for a loan of less than 22052 in 2021. Also called private mortgage insurance PMI the premium is added to your monthly payment.

Web Official interpretation of Paragraph 32 a 1 ii. Web The loan is - 1 subject to the Bureaus ability-to-repay requirements in 102643 as a covered transaction defined in 102643b1 and 2 a qualified mortgage pursuant to the Bureaus rules or for loans insured guaranteed or administered by the US. The credit score to qualify for a cash-out FHA loan refinance is often slightly higher at 620.

Web The mortgage would be a Section 32 loan if certain fees and points including the mortgage-broker fees that borrowers pay at or before closing exceed 547 2007 amount or 8 percent of the total loan amount whichever is larger. You have to prove your creditworthiness to initially qualify for a mortgage loan approval. The 20000 figure shall be adjusted annually on January 1 by the annual percentage change in the Consumer Price Index that was reported on the preceding June 1.

Web A loan becomes subject to Section 32 requirements under the points and fees test if the points and fees payable by the borrower at or before closing exceed. Web Type Of Refinance. The minimum credit score you need to refinance your home depends on the loan.

The term high-cost mortgage includes both a closed-end credit transaction and an open-end credit plan secured by the consumers principal dwelling. Web Section 32 HCMHOEPA Breakdown Including CFPB January 1 2014 - 2016 Updates HOEPA 12 CFR 102632 High-Cost Mortgage Loans General 2013 CFPB TILA amendments apply to Borrowers that purchase or already own their homes and entered into loans that met or exceeded specific cost parameters. Department of Housing and Urban Development HUD US.

These can vary slightly from lender to lender but they generally include the following. You can tap equity from a vacation home or investment property with a conventional cash-out refi. Web Credit score requirements to refinance.

5 of the total loan amount for a loan of 22052 in 2021 or more. Web You need a decent credit score. Rocket Mortgage requires a minimum 580 credit score to qualify.

Payment history is also considered as borrowers must be up to date with all loan payments from the last 6 months to be considered eligible. Different lenders have different credit score requirements. The minimum down payment is 35 with a credit score at or above 580 or 10 with a score between 500 and 579.

Refinancing with a conventional loan often requires a higher credit compared to VA and FHA loan refinances. However most FHA-approved lenders set their own credit limits. The minimum credit score to refinance typically ranges from 580 to 680 depending on your lender and loan program Your debt-to-income ratio DTI cant be too.

You as the homeowner need to have a steady income good credit standing and at least 20 equity in your home. Web The lender must give you a written notice stating that the loan need not be completed even though youve signed the loan application and received the required disclosures. Web FHA loans have a 500 minimum median qualifying credit score.

Show A 5 percent of the total loan amount for a transaction with a loan amount of 20000 or more. The Federal Reserve Board adjusts the dollar amount annually based on changes in the Consumer Price Index. The lower your credit score and down payment the higher the monthly PMI cost.

What Documents Do You Need To Refinance Your Mortgage A Checklist Credible

Refinancing Requirements For A Mortgage What To Know Fox Business

Simple Steps To Determine If You Should Refinance Your Mortgage Wrenne Financial Planning Lexington Ky

Refinance Requirements What You Need To Refinance Your Home

4 Reasons To Refinance Your Mortgage Zillow

Low Interest Mortgage Rates Nv Ca Co Nm Wa Or Id

16828 E 32nd Ave Greenacres Wa 99016 Realtor Com

Don T Be Overwhelmed With Paperwork Valley West Mortgage

Refinance Rates Learn About Home Mortgage Refinance Rates Total Mortgage

Mark Moccero Mortgage Broker Hawthorn Kew Richmond Mortgage Choice

Refinance Your Mortgage Without Starting Over At 30 Years

What Credit Score Is Needed To Refinance My Mortgage Forbes Advisor

1517 W Grace Ave Spokane Wa 99205 Realtor Com

Slight Increase In Mortgage Rates Takes Refi Potential Down A Peg National Mortgage News

Ai For Mortgage Lending Automation

Conventional Refinance Loan Requirements 2021 Anytime Estimate

Should I Refinance My Mortgage Ramsey